The Best Guide To Tips To Improve Digital Banking Experiences

Table of ContentsThe Ultimate Guide To Ways To Boost Your Digital BankingWays To Boost Your Digital Banking for DummiesHow To Get More Online Banking Customers for Beginners

It's a reality, that as an economic institution, you have a wonderful responsibility for your customers' fulfillment. You should do your finest work to shut all those voids which exist in your service. It is the 21st century, and your development primarily depends upon the electronic financial experience of your client.

Customers see thousands of messages a day which implies your messages run the risk of getting shed in that sea of thousands (along with all the ads from other financial institutions and cooperative credit union). So, if you desire your digital abilities to stick out, concentrate http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/digital banking experience on the advantages. What do individuals truly want? What benefit can they not live without? Just how do you offer that to them? And, to assist your own stand out, distinguish your electronic remedy with these 4 methods.

Which of the below is a lot more engaging? "50 Gigs of Storage Area" or "Conserve up to 10,000 of your valued pictures." When it comes to your electronic financial abilities, zero in on one of the most beneficial, engaging benefitsand emphasis on that as your beginning point. Tap into the feelings of the reader.

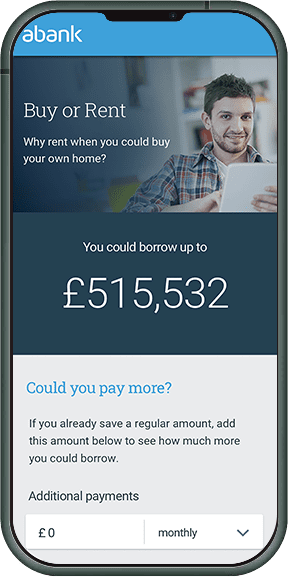

As clients start to make use of even more on-line financial solutions, their expectations have actually boosted and also changed. In years past, clients mored than happy with standard on the internet account monitoring that allowed them watch details for existing accounts. Currently, customers desire to have the capability to send out cash to a range of accounts, gain access to credit card benefits, as well as personalize their account settings from anywhere.

An Unbiased View of Simple Steps For Increasing Digital Banking Adoption

As obtains smarter and quicker, banks are brainstorming even more ways to market their services as well as assist their customers make much better economic options. Banks can raise new sign-ups and also by investing in involving, pertinent attributes that make the most of the wide range of information readily available on customers. Clients have a vast array of demands depending on the services they're accessing, their way of lives, and also the innovation available to them.

The added convenience of electronic financial makes it much easier for customers to pay their costs on-time whenever they keep in mind, as opposed to handling paper kinds or phone calls. This can minimize late settlements as well as charges, enhancing customer contentment as well as trust., as well as banks can boost and also market their protection efforts to draw in and retain customers.

By utilizing maker learning to teach AI programs regarding client trends scuffed from large information, banks can find and also flag deals that are unusual as well as most likely to be deceptive. Customers don't like managing duds, so financial institutions have to obtain the to keep false positives to a minimum. When consumers feel their account information is firmly protected, they are less likely to shut bank card or take other actions to decrease their dependence on a financial institution.

In today's significantly digital world, consumers have a lot more selections than ever before even more. Banks have to look for brand-new ways to involve consumers through digital channels, while making certain an individual and also relatable customer experience. Studies show that economic organizations that focus on "humanizing" the digital financial experience are much better able to develop depend on https://www.sandstone.com.au/lendfast with consumers as well as separate their institutions in a commoditized market.

The Ultimate Guide To Want To Improve Online Banking?

about digital disturbance in economic solutions, large financial institutions are really holding their very own. Globally, financial-services incomes have actually grown 4 percent every year over the previous 10 years (many thanks largely to growth in emerging markets), and also fintech start-ups and also big technology business have thus far recorded only small bits of market share.

Investors think fintech start-ups will become a substantial pressure in the future, valuing those in the US at $120 billion, or 7 percent of the total equity of US banks. As we see it, several financial institutions haven't set their views almost high enough in feedback to turbulent assailants. They've been overly careful, playing protection, with me-too digital campaigns mainly designed to counter relocations by actual or prospective disruptors.

Big bankslike numerous incumbentshave been swamped with new modern technologies as well as service opportunities, leaving them overwhelmed about where to concentrate and dissipating their resources. Many huge financial institutions have the devices as well as benefits to press the borders of their existing organization designs. And they're certainly motivated. What hampers their progression is unpredictability concerning just how ideal to build on core staminas to create lasting results.

Financial institutions have actually long depended on making consumers conscious of pertinent products as a path to development. In the past, that approach had to do with presenting various other banking items. For instance, a client with a bank account would be urged to consider a line of credit, a home-improvement financing, or a financial institution credit report card (see inner circle of display, classified Core).

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA